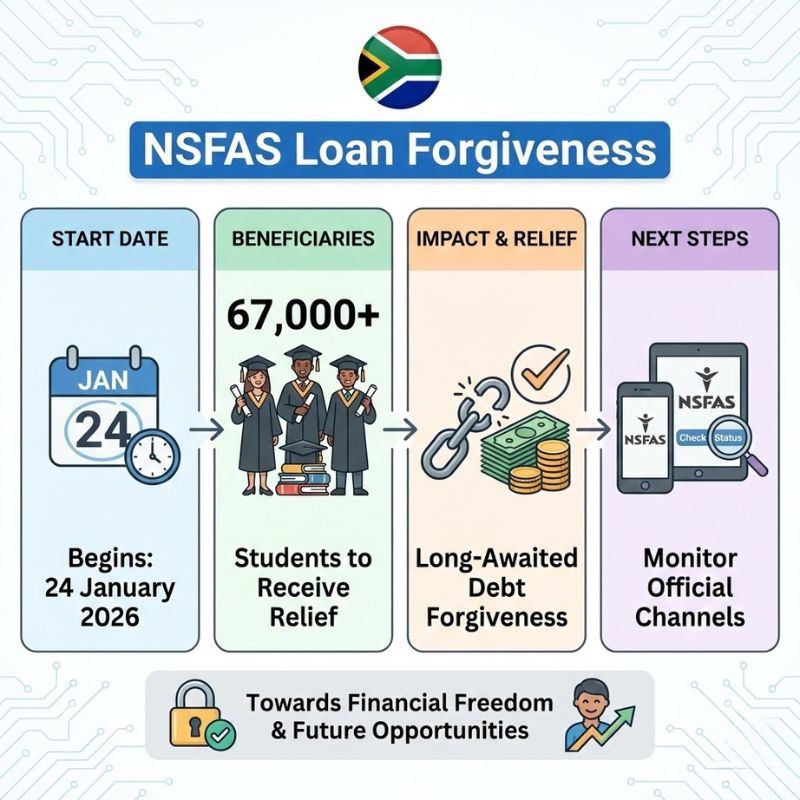

The National Student Financial Aid Scheme (NSFAS) will officially start its loan forgiveness program in 2026. This program will help thousands of former students across South Africa. It aims to reduce the financial pressure on graduates who received NSFAS loans and struggled to repay them after completing their studies. The loan forgiveness initiative represents a significant step toward making higher education more accessible and less financially stressful for South African students. Many graduates have faced challenges in repaying their student loans due to unemployment or low starting salaries in their early careers. This program acknowledges these difficulties and offers relief to those who need it most.

Key Reasons NSFAS Loans Are Being Forgiven

Over the years many students who received NSFAS funding accumulated large debts because of the old loan system. High unemployment rates and low starting salaries combined with a weak economy made it difficult for graduates to repay what they owed. The university student funding program designed to help struggling graduates has played a role in supporting these young workers during their financial difficulties.

Which Students Qualify for Loan Forgiveness

Not all former NSFAS recipients will automatically qualify for the loan forgiveness program. The debt cancellation only applies to students who completed their funded courses and met the requirements of their original funding agreement & income thresholds. Students who dropped out before finishing their studies or broke NSFAS rules may still need to repay their loans. The University checks both academic records and income levels to determine eligibility.

Automatic Reviews With No Manual Applications

One major feature of the 2026 loan forgiveness program is that borrowers do not need to submit a manual application. NSFAS will automatically review accounts through its internal systems to determine which ones qualify for forgiveness. After confirming that someone meets the eligibility requirements the organization will either reduce the remaining loan balance or cancel it entirely based on that person’s specific circumstances.

Strict Eligibility and Compliance Verification

NSFAS implemented strict verification measures to protect public funds & ensure their proper use. The organization cross-checks study completion records along with employment and income data. This process aims to support students who truly need assistance while maintaining accountability and preventing misuse of the system.

How Loan Forgiveness Supports Graduates

Loan forgiveness provides important financial relief for those who qualify. When student debt gets canceled or reduced it leads to an improved credit score and less money-related anxiety. People can then concentrate on advancing their careers or pursuing additional education & personal ambitions. It also reduces how long student loans affect the lives of young adults.

Important Steps Former Students Should Take

Former grant recipients should check their NSFAS online portal and messages from their institution on a regular basis for updates. They do not need to submit a new application but they should make sure their personal information and contact details are current to avoid any delays. Any changes to the amounts they owe will appear right away in their account.

A Major Move Toward Financial Stability

The first implementation of the NSFAS loan cancellation in 2026 will mark an important turning point in how South Africa handles student funding. The program aims to eliminate old debt while maintaining clear eligibility requirements. This approach will provide relief to students & demonstrate to taxpayers that their investment in education is being managed responsibly. The initiative addresses a longstanding challenge in the higher education system. t.