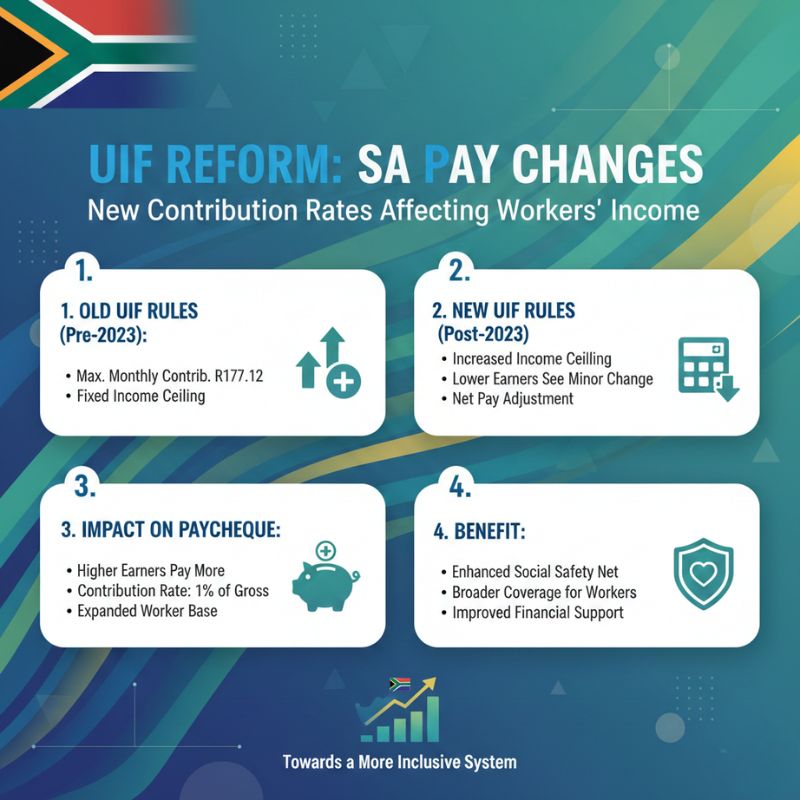

South African workers are entering a new phase of payroll deductions as the government updates long-standing Unemployment Insurance Fund rules. The changes affect how much both employees and employers contribute each month, which directly influences take-home pay. While UIF has always been a safety net during job loss or maternity leave, the revised structure aims to modernise funding and improve sustainability. For many earners in South Africa, these adjustments may look small on paper but feel noticeable in real monthly budgets.

New UIF contribution rules reshape salaries

The updated UIF contribution framework introduces clearer limits and tighter calculations that impact monthly payslips. Employees will notice adjustments tied to percentage-based deductions, while employers must align systems with revised thresholds. These changes are designed to strengthen the fund without overburdening workers, yet even modest tweaks can affect cash flow. For lower and middle earners, monthly payroll impact becomes more visible, especially when combined with rising living costs. Employers are also adapting to updated compliance rules, ensuring contributions are accurately submitted. Overall, the intent is to balance fairness with sustainability while maintaining reliable UIF coverage.

How UIF changes affect take-home pay

Take-home pay is where most workers feel the difference first. With the new structure, deductions may shift slightly depending on income brackets and capped earnings. While the UIF rate itself remains familiar, the way it applies now creates a net salary adjustment for many households. Some employees may see minimal changes, while others notice a small but consistent reduction. Over time, this adds up, making budget planning essentials more important than ever. The upside is improved fund stability, offering stronger support during unemployment or leave periods, reinforcing long-term worker security.

What South African employers must update

Employers play a key role in making the new UIF rules work smoothly. Payroll systems must be recalibrated to reflect revised earning ceilings and accurate contribution splits. Failing to update processes could result in penalties or reporting errors, so many businesses are prioritising audits. Clear communication with staff helps reduce confusion around deductions and builds trust. From HR teams to accountants, adapting early ensures regulatory alignment and avoids disruptions. Ultimately, compliance supports a healthier UIF system that benefits both employers and employees across South Africa.

Understanding the bigger UIF picture

Beyond monthly deductions, the UIF overhaul reflects a broader effort to future-proof worker protections. By refining contribution calculations, the government aims to ensure the fund remains viable during economic stress. For employees, this means accepting small changes now for stronger safety nets later. Employers benefit from clearer rules and predictable obligations. When viewed holistically, the reform supports sustainable social insurance while maintaining fairness. The key is awareness—understanding how these changes fit into personal finances and workplace planning leads to smarter financial choices.

| Category | Old UIF Rules | New UIF Rules |

|---|---|---|

| Employee contribution | Fixed percentage | Percentage with cap |

| Employer contribution | Matched rate | Matched with updates |

| Earnings ceiling | Lower threshold | Revised higher limit |

| Payroll reporting | Basic submissions | Enhanced compliance |

Frequently Asked Questions (FAQs)

1. Who is affected by the new UIF rules?

All formally employed South African workers and their employers are impacted.

2. Will my UIF rate increase?

The rate stays similar, but calculation changes may slightly alter deductions.

3. Do employers need to re-register?

No re-registration is needed, but payroll systems must be updated.

4. When do the new rules apply?

The revised UIF contribution rules apply from the official implementation date.