South Africa’s social assistance system is entering a stricter era as the South African Social Security Agency (SASSA) intensifies oversight of grant recipients’ financial activity. The latest monitoring drive targets unreported income, warning beneficiaries that inconsistencies could now lead to immediate suspensions. This nationwide move reflects broader efforts to protect limited public funds while ensuring grants reach those who genuinely qualify. For millions who rely on monthly support, the changes signal a clear shift from trust-based reporting to data-driven verification, making transparency more important than ever.

SASSA Grant Monitoring Tightens Across South Africa

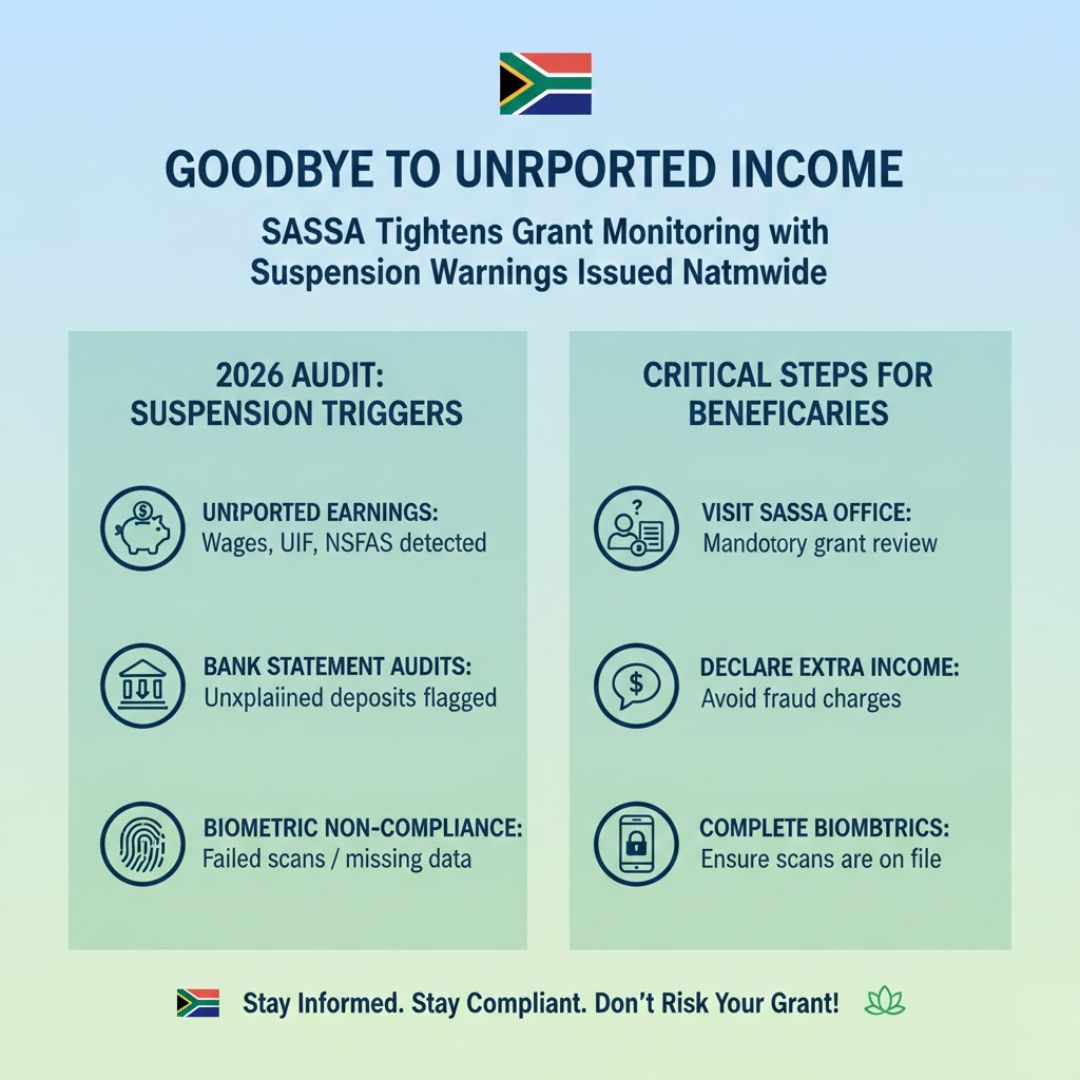

SASSA’s upgraded monitoring system now connects multiple databases to detect income that was previously overlooked. By matching grant records with banking and employment information, officials can quickly flag discrepancies and follow up with beneficiaries. This process relies on income cross-checks to compare declared earnings, while bank data links help identify unexplained deposits. Automated real-time alerts allow faster intervention, reducing long delays that once plagued investigations. The agency says the goal is not punishment, but preserving grant integrity so assistance remains sustainable for those who truly depend on it.

Unreported Income Triggers SASSA Suspension Warnings

When inconsistencies appear, beneficiaries may now receive immediate notifications explaining the issue and the next steps. These suspension notices are designed to prompt quick action rather than cause panic. Clear response deadlines give recipients a window to clarify their situation, submit documents, or correct errors. SASSA has also expanded appeal channels, allowing individuals to challenge decisions without visiting crowded offices. In many cases, grants are placed on temporary holds until verification is complete, minimizing wrongful terminations while enforcing accountability.

How SASSA Grant Compliance Rules Are Changing

The latest rules require beneficiaries to be more proactive about keeping their information current. Regular updated declarations are encouraged whenever financial circumstances change, even slightly. Behind the scenes, monthly reviews replace older annual checks, making the system more responsive but also less forgiving. Officials say this promotes a stronger compliance culture built on honesty rather than fear. With expanded digital reporting tools, recipients can update details online or through assisted channels, reducing the risk of accidental non-compliance.

What This Means for Grant Beneficiaries

For most recipients, the tighter monitoring represents a shift toward long-term stability rather than immediate threat. Greater system transparency helps explain how decisions are made, while clearer rules support fair distribution of public funds. The key adjustment lies in beneficiary awareness, as understanding obligations becomes just as important as meeting eligibility. Ultimately, consistent policy enforcement aims to protect vulnerable households by ensuring resources are not drained through inaccurate reporting.

| Monitoring Area | What SASSA Checks | Possible Outcome |

|---|---|---|

| Bank Activity | Undeclared deposits | Verification request |

| Employment Data | Active income sources | Grant adjustment |

| Personal Details | Status changes | Record update |

| Non-Response | Missed deadlines | Temporary suspension |

Frequently Asked Questions (FAQs)

1. Why is SASSA focusing on unreported income?

To ensure grants are paid only to eligible individuals and prevent misuse of limited funds.

2. Will all unexplained income lead to suspension?

No, beneficiaries are given a chance to explain or correct records before final action.

3. How can beneficiaries update their information?

Updates can be made through SASSA offices, online platforms, or assisted service points.

4. Are these monitoring rules permanent?

Yes, they form part of an ongoing shift toward continuous grant verification.